Governance

Governance

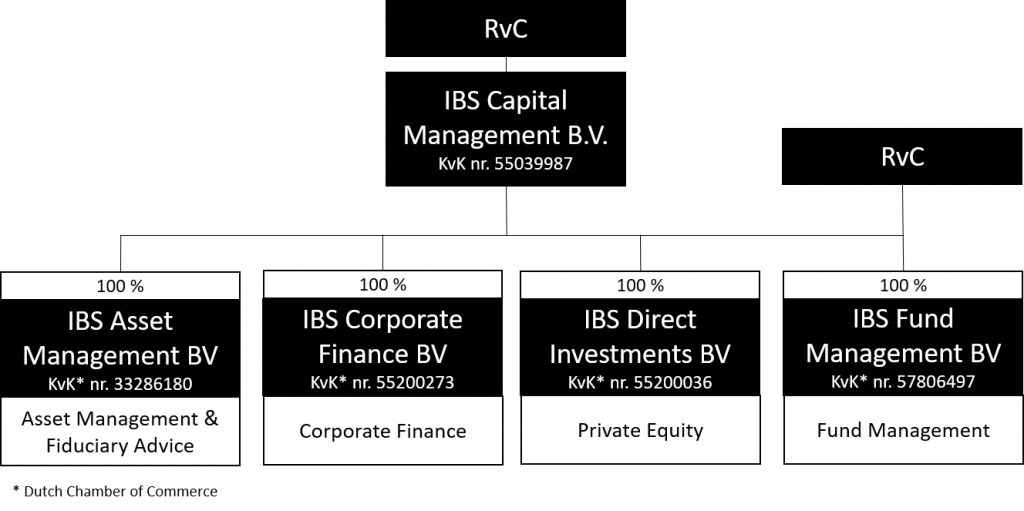

Our organisational structure follows a logical setup according to our activities. IBS Capital Management BV is the sole shareholder of four companies:

- IBS Asset Management BV (activities in the fields of asset management and fiduciary management in the Netherlands)

- IBS Direct Investments BV (activities in the field of private equity)

- IBS Corporate Finance BV (activities in the field of corporate finance)

- IBS Fund Management BV (investment fund management)

This way, all of IBS’ activities are clearly organised in separate companies. A Supervisory Board oversees all the aforementioned companies.

IBS Capital Allies is the trade name of IBS Capital Management BV and its subsidiaries IBS Asset Management BV, IBS Direct Investments BV, IBS Corporate Finance BV and IBS Fund Management BV.

Jacco Rijnbeek, Harold Knebel, Tim Timmermans, Ferry van der Wurf and Hans Betlem are shareholders in IBS Capital Management BV through their personal holding company. On the basis of this, they use the title of Partner. Furthermore, IBS Capital Management BV also has three minority shareholders who are not actively involved in daily operations.

The Supervisory Board consists of Thomas van Rijckevorsel, Hein Hooghoudt and chairman Willem Bröcker.

ISAE

IBS Asset Management BV has an ISAE 3402 Type II statement. This stands for International Standard on Assurance Engagements number 3402, a guideline for the certification of internal control of processes in service organisations. It describes management objectives and control measures. The statement also covers relevant IT processes, systems and applications. An auditor tests whether these are effective.

Regulators

IBS Asset Management BV has been issued with an investment firm licence from the AFM (the Netherlands Authority for the Financial Markets). IBS Asset Management BV’s equity capital is more than sufficient to continuously meet the capital requirements of DNB (the central bank of the Netherlands). IBS’ other companies also have adequate capital.

Most of IBS’ employees are DSI- and VBA-certified. The employees affiliated with the VBA (the Association for Investment Professionals) and/or the Dutch Security Institute (DSI) are bound by the respective Codes of Conduct. All our employees are subject to an internal insider regulation that includes rules on private investments and conflicts of interest. All employees have also taken the Banker’s Oath in which they have declared that they will perform their duties with integrity and care.

We are affiliated with Kifid (the Dutch Institute for Financial Disputes) and accept the judgements of the Dutch Foundation for Consumer Complaints Boards (De Geschillencommissie) as legally binding.

IBS Fund Management BV holds an AIFMD licence from the AFM in accordance with Section 2:65 of the Dutch Financial Supervision Act. All the investment companies managed by IBS Fund Management BV are registered with the AFM.

Financial Statements

The Annual Report is prepared in accordance with the accounting principles generally accepted in the Netherlands (‘Dutch GAAP’). The annual accounts are filed with the Dutch Chamber of Commerce, where the documents are available to everyone.

No proprietary trading

IBS Asset Management BV does not have its own trading portfolio and does not take positions itself for trading reasons. IBS Asset Management BV only trades on its clients’ behalf and risk.

Remuneration Policy

We apply a controlled remuneration policy that complies with the Dutch Remuneration Policy (Financial Enterprises) Act. There is no relationship between the returns achieved, the risk taken and the amount of variable remuneration. Variable remunerations are bound to a statutory maximum.

We also take sustainability and the associated risks into account. These sustainability risks relate to IBS itself, our employees, investment policy and customers. The degree to which these sustainability risks are controlled, affects part of the variable remuneration of employees and aims to create a positive effect on the management of sustainability risks. This variable remuneration fits within the framework of the Financial Enterprises Remuneration Policy Act.

Privacy

Our services are based on trust. Trust that we will listen to you carefully, trust that we will use your information to provide you with the best possible service, and trust that we process your personal data in such a way that your privacy is guaranteed. This is inextricably linked to our mission: to be the best possible ally. Our privacy statement includes everything you need to know about how we handle your personal data.

Best Execution Policy

Investment firms such as IBS Asset Management BV are required by law to take adequate measures to obtain the best possible results when executing a client’s orders. This obligation is referred to as the Best Execution obligation. In our Best Execution Policy, we explain how we fulfil this obligation. What’s more, we also provide an annual overview of the trading places we used that given year.

Conflicts of Interest

In the context of (potential) conflicts of interest, we announce that, as part of its services, IBS Asset Management BV can also advise clients on investment companies managed by IBS Fund Management BV, provided that they are suitable for the clients. IBS Asset Management BV and IBS Fund Management BV have taken measures to manage this potential conflict of interest.

Complaints

At IBS, we do everything we can to ensure our clients are satisfied. If, however, you are not content with the services of any IBS company, please do not hesitate to let us know so we can find a suitable solution for you. You can find out about our complaints procedure here.